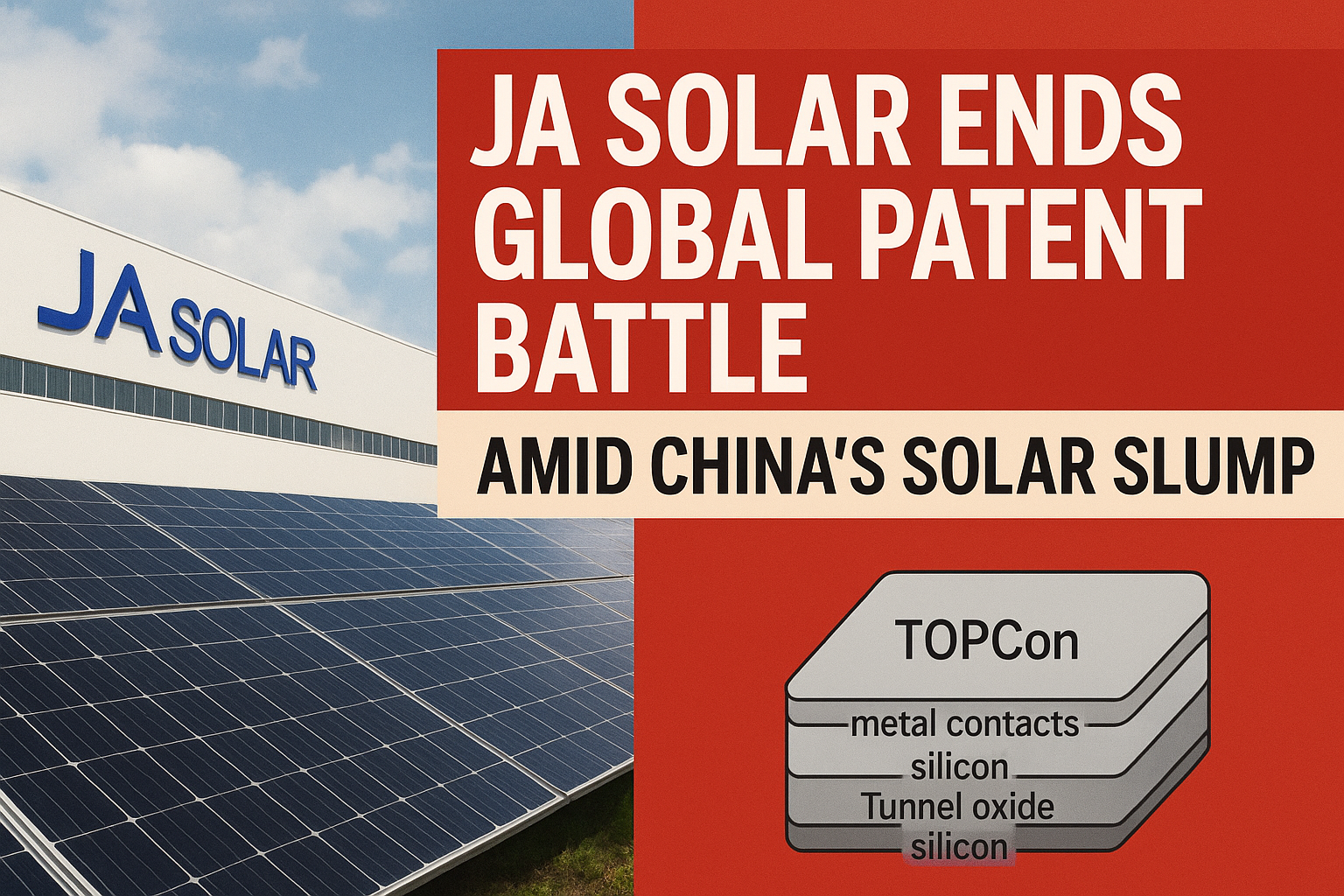

On 29 November 2025, JA Solar announced that it has reached a global settlement with rival Chint New Energy to end all ongoing litigation over proprietary solar-cell technology. The agreement ends lawsuits worldwide and establishes a cross-licensing pact covering their respective “TOPCon” patents.

Under the accord, neither party will file any new patent suits concerning those TOPCon patents. The move draws a line under a bitter legal battle over advanced solar-cell designs — and signals a shift in approach for China’s embattled photovoltaic (PV) industry.

Context: From price wars to patent wars

The settlement comes against a backdrop of severe stress in China’s solar-panel sector. In the first half of 2025, JA Solar — along with other major PV producers — reported steep losses as falling module prices and persistent oversupply eroded profitability.

Analysts warn that this downturn is more than cyclical. After rapid capacity expansion between 2020 and 2023, China’s PV production capacity now far exceeds global demand. According to the company’s own filings, wafer, cell, and module production have all outgrown realistic market needs — triggering a prolonged slump in prices across the supply chain.∙

In response, many firms have cut jobs and scaled down operations: collectively, the top solar manufacturers shed nearly one-third of their workforce in the past year.

As competition intensified, the industry’s battleground shifted from pricing to intellectual property. Companies staked their future on advanced technologies like TOPCon — a next-gen solar-cell design — and used their patent portfolios as strategic weapons.

In that context, the settlement between JA Solar and Chint New Energy stands out. It reflects a pragmatic pivot: instead of draining scarce resources on costly lawsuits, big players appear to be seeking stability and reducing legal risk.

What the Truce Means for the PV Industry

By crossing licensing rights to TOPCon technology, JA Solar and Chint New Energy effectively neutralize one dimension of internal conflict. This could ease tensions, reduce legal overhead, and help firms redirect efforts to production, innovation, or survival.

For the broader industry, the deal might mark a turning point. If other leading rivals follow suit, the era of patent-driven warfare could give way to cooperation, licensing deals, and — potentially — consolidation. Indeed, similar truce agreements have already occurred elsewhere: earlier in 2025, JinkoSolar and LONGi Green Energy ended their own global patent conflict via a cross-licensing deal.

Given the brutal economics — chronic oversupply, slim margins, and falling demand — industry insiders say cooperation may be the only path forward. Consolidation, capacity cuts, and patent sharing may be vital for survival.

What Remains at Stake

Yet, the settlement does not erase deeper structural problems facing China’s solar-panel industry. The volume of capacity far exceeds the actual demand. As a result, many firms — especially smaller manufacturers — may struggle to stay afloat.

Even large companies like JA Solar cannot guarantee profitability soon. To break even, firms may need price stabilization, capacity consolidation, cost reductions, or new demand surges — none of which are assured anytime soon.

Further, while cross-licensing may bring calm, it could also set the stage for consolidation. Companies that fail to keep up may be forced to exit — leaving fewer, more powerful players controlling the global supply of solar modules. That could reshape global solar-module sourcing, trade, and pricing for years ahead.

Why This Matters Globally — and for Solar Buyers

For markets importing Chinese solar modules — including India — the truce could lead to a more stable supply environment. Reduced legal uncertainty and potential consolidation may result in steadier module availability.

At the same time, fewer but larger players controlling core technologies could reshape competition. Buyers may face a narrower pool of module suppliers, and prices may become more rigid.

In short: while the patent battle is over, a larger fight — for survival and dominance in a global oversupplied solar market — has just begun.

Bottom line: JA Solar’s settlement with Chint New Energy closes a chapter of acrid patent warfare. Yet, it does not signal a rebound. Instead, it highlights a harsh reality: China’s solar-panel giants must adapt — or risk being swept away in a global shake-out.