The Delhi High Court slams the door on Zydus Healthcare’s bold challenge. Swiss innovator Helsinn Healthcare SA emerges victorious. Justice Tejas Karia dismisses Zydus’s writ petition outright on December 24, 2025. The court upholds a key patent for a breakthrough anti-nausea drug.

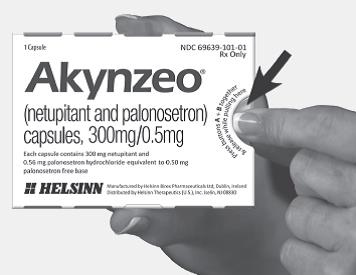

Helsinn triumphs. The patent protects Akynzeo, a powerful fixed-dose combination. It pairs netupitant (300 mg) with palonosetron (0.5 mg). This duo targets chemotherapy-induced nausea and vomiting (CINV). Cancer patients endure brutal side effects from treatment. Akynzeo attacks both acute and delayed phases. It blocks NK1 and 5-HT3 receptors simultaneously. Patients gain long-lasting relief in one capsule.

Zydus strikes first. The Indian generic giant files a pre-grant opposition in 2021. Helsinn submits voluntary amendments during prosecution. Zydus cries foul. It claims amendments expand claims illegally. It alleges violations of Section 59 of the Patents Act. The Mumbai Patent Office rejects these arguments. Controllers grant Indian Patent No. 426553 in March 2023.

Zydus refuses to back down. It launches a writ petition in Delhi High Court. The company demands quashing the grant. It accuses the Patent Office of jurisdictional errors. It charges breaches of natural justice. Zydus insists it deserves a hearing on post-opposition amendments.

Justice Karia dismantles these claims. The court rules firmly: Delhi lacks territorial jurisdiction. The Mumbai Patent Office handled the grant. Challenges must target the appropriate High Court – Bombay. No jurisdictional error taints the process. Pre-grant opposition and examination run as separate tracks. Opponents hold no automatic right to hearings on amendments.

The judge stresses clarity. No separate order requires pre-First Examination Report amendments. Helsinn follows rules meticulously. The Patent Office issues proper notices. It provides fair opportunities. Zydus suffers no violation of natural justice.

This ruling fortifies originator protections. Helsinn shields its innovation fiercely. Akynzeo transforms cancer supportive care. Guidelines worldwide endorse this triple regimen with dexamethasone. It prevents nausea in highly emetogenic chemotherapy.

In India, Glenmark markets Akynzeo under license. Helsinn partners strategically. The drug reaches patients swiftly. Generic threats loom large. Zydus eyes early entry. Other firms like Hetero face similar battles. Helsinn secures interim injunctions elsewhere. It blocks infringing formulations aggressively.

Experts hail the decision. It curbs forum shopping. Patent challengers must file correctly. Courts intervene sparingly in administrative grants. Only glaring illegalities trigger writ relief.

Zydus explores options. The company may refile in Bombay High Court. Post-grant opposition remains open. Counterclaims arise in infringement suits. Helsinn stands ready to defend.

This clash spotlights India’s pharma battlefield. Originators safeguard rewards for risky R&D. Generics push affordable access aggressively. Combination therapies spark fierce disputes. Evergreening accusations fly often.

Patients win ultimately. Robust patents drive innovation. They deliver superior treatments like Akynzeo. Reliable relief empowers cancer fighters. They battle disease without debilitating nausea.

The industry watches closely. This precedent shapes future fights. Territorial rules tighten. Procedural challenges weaken. Innovators gain ground.

Helsinn celebrates quietly. The Swiss firm advances cancer care globally. Akynzeo leads its portfolio. Protection endures in key markets.

Zydus persists undeterred. The generic powerhouse expands relentlessly. It targets blockbuster opportunities.

India’s patent ecosystem evolves. Courts balance interests skillfully. Innovation thrives. Access improves gradually.

This victory resonates deeply. Helsinn protects a vital lifeline for millions. Cancer patients endure enough. Akynzeo eases their burden dramatically.