Global investment in artificial intelligence (AI) is rapidly transforming the international innovation landscape. A new report from the World Intellectual Property Organization (WIPO) reveals that increased funding in AI technologies is fueling a sharp expansion in patent filings worldwide.

The findings highlight a powerful shift in technological innovation. Countries and corporations are racing to secure intellectual property in emerging technologies such as artificial intelligence, digital communications, and semiconductor manufacturing.

The data signals a new phase of global technological competition. Nations that invest heavily in AI infrastructure are gaining a decisive advantage in patent activity and innovation leadership.

Global Patent Filings Continue to Grow

According to the latest report by the World Intellectual Property Organization, international patent applications filed through the Patent Cooperation Treaty (PCT) system reached approximately 275,900 filings in 2025, marking a modest but significant 0.7% increase compared with the previous year.

While the overall growth appears gradual, the deeper trend reveals explosive activity in AI-related technology sectors.

Digital communication technologies recorded the fastest growth among major technical fields. Patent filings in this sector increased by nearly 6 percent, reflecting rising investment in AI networks, data infrastructure, and connectivity technologies.

Semiconductor technologies also experienced rapid growth. The surge reflects global demand for advanced chips required to power AI systems, machine learning platforms, and large-scale data processing.

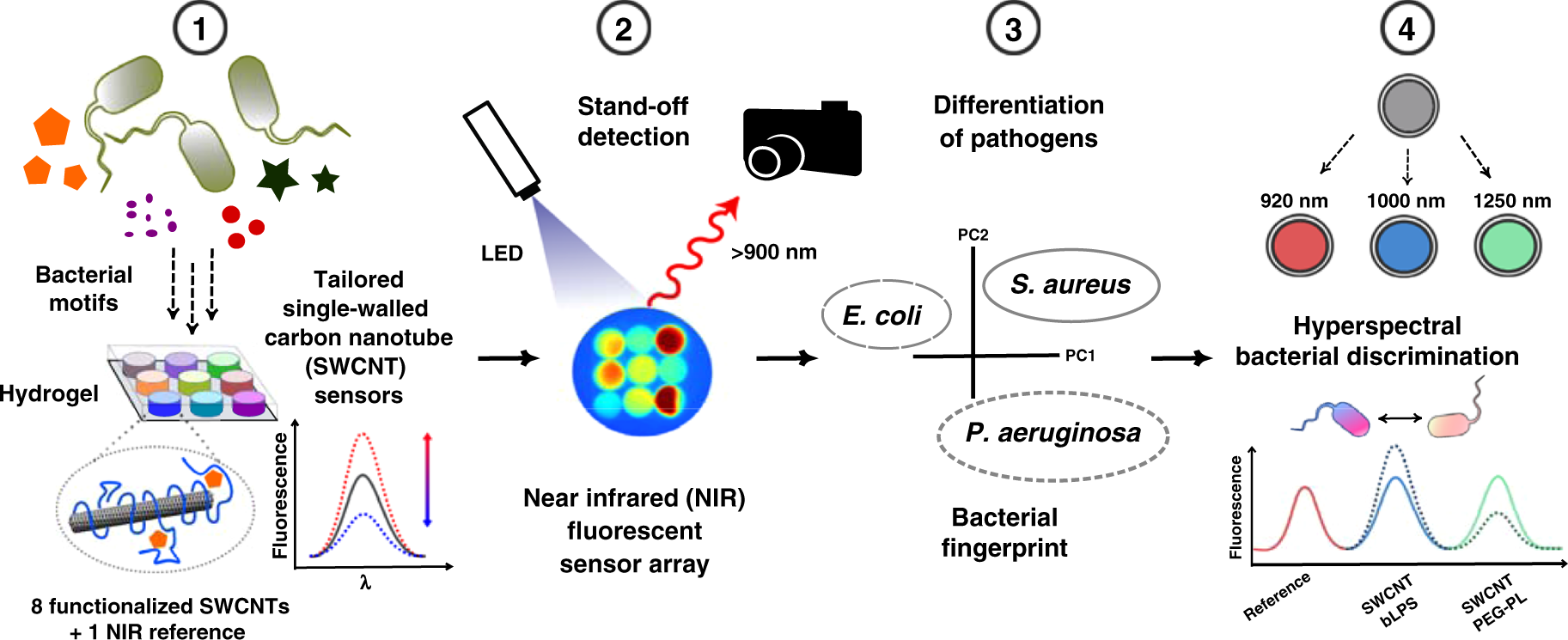

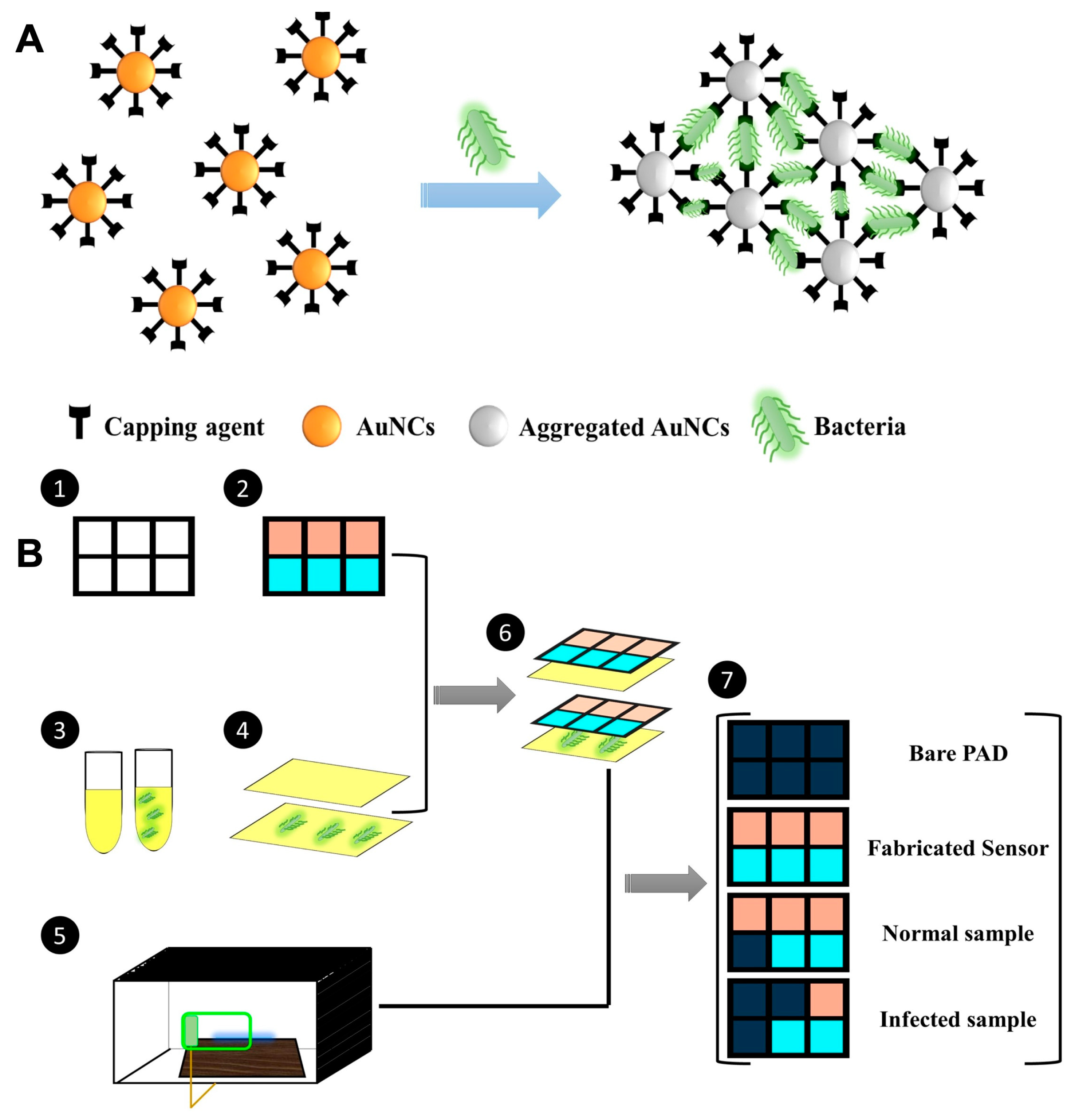

WIPO economists say the innovation shift toward AI is reshaping patent strategies across industries. Companies no longer focus only on software development. Instead, they seek protection for a complete technological ecosystem that includes hardware, computing systems, and communication networks.

AI Emerges as the Core Driver of Innovation

Artificial intelligence now sits at the center of the global innovation economy.

Governments and corporations are investing billions into AI research and infrastructure. These investments create ripple effects across multiple industries. As companies develop AI models, they also design new processors, networking equipment, and computing architectures.

Each of these innovations requires intellectual property protection.

WIPO officials emphasize that AI development relies on a complex technological stack. Advanced algorithms require powerful chips, high-speed communication networks, and massive data processing capacity. As a result, patent filings increasingly cluster around these enabling technologies.

This trend explains why sectors like semiconductors and telecommunications now dominate the global patent landscape.

China Expands Its Lead in Global Patent Filings

The report also highlights a significant geopolitical shift in innovation leadership.

China has firmly established itself as the world’s largest source of international patent filings.

Chinese applicants submitted over 73,000 international patent applications in 2025, representing an increase of more than 5 percent compared with the previous year.

This growth further strengthens China’s lead in global intellectual property activity.

In contrast, the United States recorded around 52,600 international filings, marking a 3 percent decline and the fourth consecutive year of decreasing applications.

The comparative trend signals a shift in technological momentum. China’s aggressive investment in AI research, semiconductor manufacturing, and digital infrastructure continues to translate into higher patent output.

Other major patent-filing countries include:

- Japan

- South Korea

- Germany

These countries maintain strong innovation ecosystems supported by advanced manufacturing industries and technology-driven economies.

Together, they form the backbone of global patent activity.

Technology Giants Dominate Patent Leadership

Corporate innovators remain the driving force behind international patent filings.

Telecommunications and electronics companies dominate the list of top global applicants.

Chinese telecommunications giant Huawei retained its position as the world’s largest international patent filer. The company submitted more than 7,500 patent applications under the PCT system in 2025.

This achievement marks another year of leadership for Huawei, which has consistently ranked among the top global innovators since 2017.

Following Huawei, major technology companies also maintained strong patent activity:

- Samsung Electronics

- Qualcomm

- LG Electronics

Most of the leading patent applicants operate in the information and communications technology sector.

This dominance reflects the rapid expansion of digital technologies and AI-driven innovation.

Companies compete fiercely to secure patents in wireless communications, advanced computing, chip design, and network infrastructure.

The race for intellectual property protection has become as strategic as the race to develop new technologies.

Trademark Applications Show Slight Decline

While patent filings increased slightly, international trademark activity showed a different trend.

Applications filed through the Madrid System for the International Registration of Marks declined by about 1.5 percent in 2025.

Global trademark filings fell to approximately 64,150 applications.

Economic uncertainty and slower consumer brand expansion may explain the modest decline.

However, several companies continued to maintain strong trademark portfolios.

French cosmetics leader L’Oréal remained the world’s top trademark applicant for the fifth consecutive year, demonstrating the company’s strong global brand protection strategy.

Industrial Design Filings Surge Worldwide

Another key highlight of the report is the rapid growth in international industrial design filings.

Applications submitted through the Hague System for the International Registration of Industrial Designs rose by 9.4 percent, reaching more than 28,500 designs in 2025.

China again led this category, reflecting the country’s growing focus on product design and consumer technology innovation.

Major multinational companies also contributed significantly to industrial design filings.

Leading design applicants included:

- Apple

- Procter & Gamble

- Philips

- Samsung Electronics

These companies rely heavily on design protection to secure competitive advantages in consumer electronics, healthcare products, and household goods.

Global Innovation Race Intensifies

The WIPO report underscores three powerful trends shaping the future of innovation.

First, artificial intelligence has become the central driver of technological development. Countries that invest heavily in AI infrastructure are seeing rapid growth in patent activity.

Second, Asia continues to dominate global innovation output. China, Japan, and South Korea collectively account for a significant share of global patent filings.

Third, digital technologies now define the modern patent landscape. Telecommunications, semiconductors, and computing technologies generate the highest number of new inventions.

These developments highlight the increasing strategic importance of intellectual property in the global technology race.

The Future of AI-Driven Innovation

Experts believe AI investment will continue to reshape global innovation patterns over the next decade.

Artificial intelligence is expected to transform industries ranging from healthcare and manufacturing to finance and transportation.

As new AI models emerge, companies will develop more specialized chips, faster data networks, and advanced computing systems.

Each breakthrough will generate new patents and intensify competition among technology leaders.

For policymakers, the challenge will be to balance rapid technological progress with strong intellectual property frameworks that encourage innovation while protecting creators.

For companies, the message is clear: innovation alone is not enough. Securing patents has become essential for long-term technological leadership.

Conclusion

The latest report from the World Intellectual Property Organization confirms that artificial intelligence is accelerating global patent activity and reshaping the innovation economy.

Rising AI investments are driving growth in digital communications, semiconductors, and advanced computing technologies.

At the same time, China’s expanding patent dominance and the continued leadership of global technology giants highlight the increasing intensity of the worldwide innovation race.

As artificial intelligence continues to evolve, intellectual property will remain one of the most powerful tools for securing technological advantage in the digital age.