A deep dive into the intellectual property (IP) landscape of India’s booming startup sector reveals a critical gap between ambition and execution, suggesting that the much-lauded surge in patent filings is predominantly a tactical exercise in investor signalling rather than a genuine marker of technological innovation. The core issue, critics argue, is a “crisis of intent” where patents function as “decorative rather than functional” assets.

While global bodies like the World Intellectual Property Organization (WIPO) have celebrated India’s rapid ascent—the WIPO 2024 report noted a phenomenal 15.7% growth in patent applications in 2023, positioning the country 6th globally with 64,480 filings —the internal data paints a sobering picture of weak follow-through.

The Data Gap: 83% of Startup Patents Fail to Secure a Grant

Analysis of the startup patent pipeline from 2021 through 2025 reveals a profound drop-off rate, demonstrating that the vast majority of filings are not carried through to completion.

During this five-year period, Indian startups filed a robust 13,089 patent applications. Yet, only 2,174 of these successfully navigated the examination process to achieve the grant stage. This results in a grant success rate of barely 16.6%, meaning approximately one out of every six startup filings becomes an enforceable, proprietary asset.

The failure rate is compounded by active abandonment. Nearly 500 startup patent applications were explicitly withdrawn or abandoned early, often due to the filers failing to complete detailed specifications or respond to subsequent office actions required by the Patent Office.

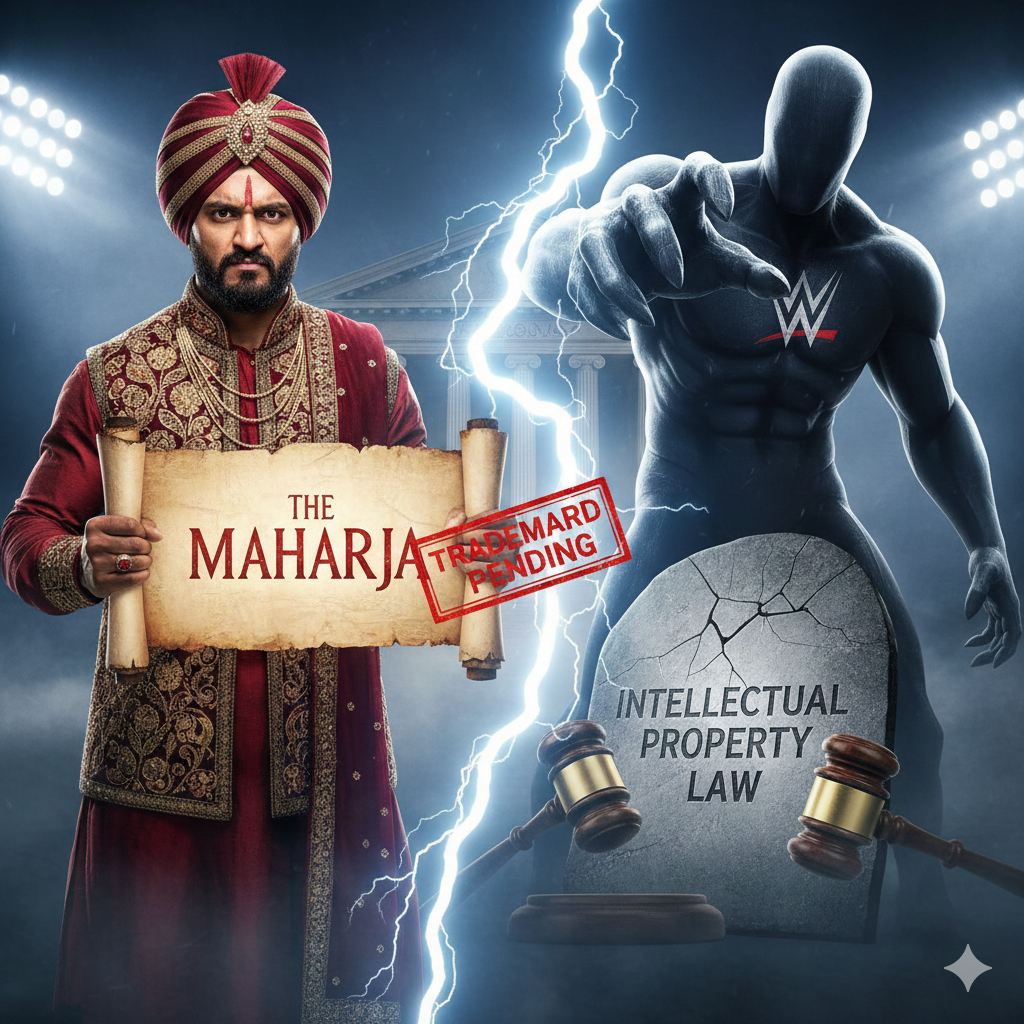

This pattern extends beyond patents. Startups filed 44,517 trademark applications during the same period, with over 1,300 subsequently abandoned. Analysts suggest this widespread non-prosecution across IP types confirms that the primary function of the filing is “brand optics” rather than a rigorous, long-term IP strategy. The high volume of dropped applications confirms that for many, the intent was temporary and instrumental: the patent filing was merely a transaction used to secure funding, not an investment in an enduring intellectual asset.

Investor Mandate: Patents as Pitch Deck Tools

The distortion in filing behaviour is traced back to the venture capital (VC) ecosystem’s preference for strong valuation narratives. In competitive fundraising rounds, a pending patent application, particularly a cheap and fast provisional filing, serves as a high-visibility proxy for technological differentiation and market moat potential.

A provisional patent application, which secures an immediate priority date, is leveraged as a “fast, affordable way to strengthen a fundraising narrative” and “create the appearance of a breakthrough innovation”. This mechanism enables a “Capital first, commitment later” ethos.

The systemic issue is rooted in the fact that investors often prioritize the inclusion of an IP slide over demanding proof of prosecution commitment or demonstrated R&D investment. As the analysis notes, “Once the funding round closes, priorities may shift,” leading to a predictable loss of enthusiasm for the labour-intensive and expensive work required to turn provisional filings into complete specifications. This rational response by founders—underinvesting in expensive, long-term R&D in favour of cheap, high-volume filing tactics—systematically shifts resources away from core innovation.

Structural Deficiency: India’s R&D Investment Stagnation

The crisis of intent at the startup level is underpinned by a deep, structural R&D deficit at the national level. The commitment to deep, foundational research necessary to generate truly novel and patentable inventions remains structurally low in India.

Official data from the Department of Science & Technology (DST) confirms that India’s Gross Expenditure on Research and Development (GERD) as a percentage of GDP stood at 0.64% during the fiscal year 2020–21, having remained stagnant between 0.6% and 0.7% in the preceding years (0.66% in 2018–19 and 2019–20).

This figure is significantly “below global average and lower than countries like China, South Korea and US”. This structural weakness is compounded by low private sector contribution, which accounted for only 36.4% of the total GERD in 2020–21, in sharp contrast to innovation-leading nations where private industry drives over 70% of R&D expenditure.

This macro-level underinvestment directly correlates with the micro-level deficiencies, as most startups lack “dedicated research teams, technical drafting expertise, prior-art assessment systems, and time for iterative processes” necessary for rigorous patent prosecution.

Policy Flaw: Incentives Reward Filing, Not Granting

Current government policies designed to stimulate IP activity, while successful in boosting filing volume, have inadvertently intensified the focus on volume over quality. The government successfully implemented significant fee concessions, including an 80% reduction in patent filing fees for startups, MSMEs, and educational institutions.

However, the design flaw is that these incentives are tied to the input stage (filing) rather than the output stage (grant or commercialization). By heavily subsidizing the initial filing, the state inadvertently subsidizes the creation of the fundraising narrative for VCs. Once the provisional application is lodged, the startup has secured its priority date and the narrative benefit, but the subsequent costly work of prosecution remains unassisted, cementing the low-commitment behaviour.

Blueprint for Genuine Innovation: Shifting from Decoration to Depth

To foster genuine innovation and correct the systemic inefficiencies, experts advocate for a strategic overhaul of incentives and infrastructure.

- Realign Incentives: Government benefits, including subsidies and fast-track examination provisions, must be decoupled from the act of filing and strategically tied to demonstrable outcomes, such as patent grants, successful long-term renewal, or demonstrable commercial utilization.

- Enhance Capacity: Urgent investment in the Patent Office is mandatory, including expansion of examiner capacity and specialized domain expertise. There is a pronounced need for more technically specialized patent officers, particularly in cutting-edge technological areas like AI, biotech, semiconductors, climate-tech, and advanced manufacturing.

- Strengthen R&D Culture: The government should offer targeted, co-funded grants and innovation-linked incentives for startups that demonstrate a commitment to establishing and maintaining dedicated R&D teams or formalized collaboration with research institutions.

- Promote Co-patenting: Actively promoting policy frameworks that encourage joint patent filings (co-patenting) between startups and premier academic/research institutions, such as the IITs and national labs, would guarantee a higher technical standard for the filings and create structured pathways for knowledge transfer.

The conclusion remains clear: for India to genuinely transition from an IP volume leader to a global innovation power, the focus must shift from decorative filings to functional intellectual assets. Only then can “depth replace decoration” and solidify India’s reputation as a serious, quality-driven innovation hub.